pay indiana state estimated taxes online

Unfortunately the Tax Cuts and Jobs Act limits this itemized deduction to 10000 for tax years 2018 through 2025 and to just 5000 if youre married and filing a separate return. You will need your Assessors Identification Number AIN to search and retrieve payment information.

Indiana Dept Of Revenue Inrevenue Twitter

Installment Agreement Request POPULAR FOR TAX PROS.

. At the time I was unable to pay for a second state and open a Indiana return. How to pay estimated taxes in Indiana. It is a separate and.

This way you wont need to pay all your tax at one time when you file. Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. Your state will also have estimated tax payment rules that may differ from the federal rules.

Youll find state-specific instructions are generally easy to. Every state has different requirements for this but its usually also quite painless. Paying your state.

Employers engaged in a trade or business who pay compensation Form 9465. On average the nations estimated 11 million undocumented immigrants pay 8 percent of their incomes in state and local taxes every year. If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form.

All 92 counties in the Hoosier State also charge local taxes. Im having an issue with my 2016 taxes. Rates do increase however based on geography.

Another deduction you can take on your federal return to try to nip away at your tax bill is for the income taxes you must pay to your state on your winnings. Box 802502 Cincinnati. Pacific Time on the delinquency date.

But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. Pay my tax bill in installments. You can make online payments 24 hours a day 7 days a week up until 1159 pm.

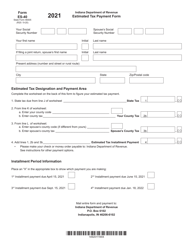

Indiana Form ES-40 is used to pay estimated taxes. Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status. Find out how to pay estimated tax.

Visit the Indiana Department of Workforce Development to learn more about filing for unemployment andor signing up to have Indiana State and county tax withheld. Overview of Indiana Taxes. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

While it is unlikely to happen in the current political environment undocumented immigrants state and local tax contributions could increase by up to 21 billion under comprehensive immigration reform. Find Indiana tax forms. As long as I pay in a combo of estimated taxes and w2 withholding 100 of previous year tax liability or 110 if 150K AGI I should be safe.

After updating my software yesterday and going to amend my taxes now TurboTax says they dont think I need to file a Indiana return and. If you live or earn money in one of the other 41 states or the District of Columbia you may need to file a state income tax return by the filing deadline. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Originally turbo tax calculated that I owed Ohio approximately 8000 because of my gambling winnings in Indiana. The credit for taxes paid to another state section will be at the end of your residence states interview process. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

Unlike the federal income tax system rates do not vary based on income level. Put some money back to ensure you are able to pay your taxes. These local taxes could bring your total Indiana income tax rate to over 600 depending on where you live.

If your state collects income taxes youll need to also make a state estimated tax payment. Usually thats enough to take care of your income tax obligations. Indiana state filing information for tax-exempt organizations.

If you have taxable income from self-employment interest dividends unemployment compensation and pensions you may have to pay estimated tax to the state of Indiana. Pay your taxes online using your checking account or creditdebit card. Claim a gambling loss on my Indiana return.

Know when I will receive my tax refund. Download Indiana Form ES-40 from the list of forms in the table below on this page. Please note that you will only get a tax credit for your IL state income taxes up to the amount of IN state income taxes that would have been paid if the income was earned in IN.

Take the renters deduction. See IRSgov for details. Indiana Internal Revenue Service PO.

Have more time to file my taxes and I think I will owe the Department. At the time of this writing the only states that do not charge a state income tax are Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming.

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Quarterly Tax Calculator Calculate Estimated Taxes

Dor Owe State Taxes Here Are Your Payment Options

Dor Owe State Taxes Here Are Your Payment Options

Indiana Dept Of Revenue Inrevenue Twitter

Dor Indiana Extends The Individual Filing And Payment Deadline

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

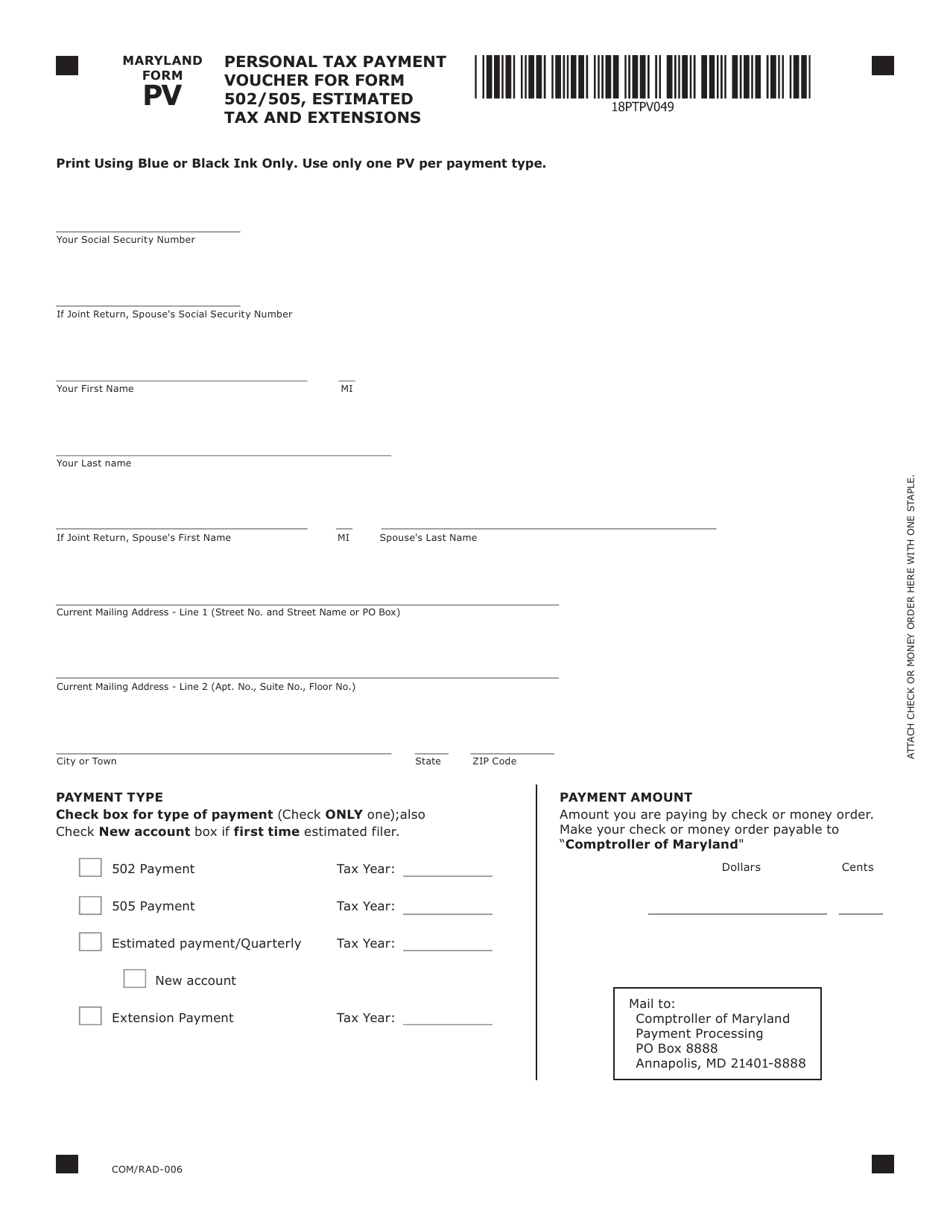

Maryland Form Pv Com Rad 006 Download Fillable Pdf Or Fill Online Personal Tax Payment Voucher For Form 502 505 Estimated Tax And Extensions Maryland Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

Quarterly Tax Calculator Calculate Estimated Taxes

Indiana State Tax Information Support